The W-4 form is what your employer/payroll department uses to calculate the withholding on your paycheck.

It used to have you claim “exemptions” per person in your household. You probably remember claiming something like Single 3 or Married 4. Well those are the days of the past!

The new forms are going to be a lot more complicated. So complicated that they pushed back the release date from 2019 to 2020.

You will now need to know details from your tax return in order to fill out the new form so make sure to have a copy of your 2018 or 2019 taxes handy.

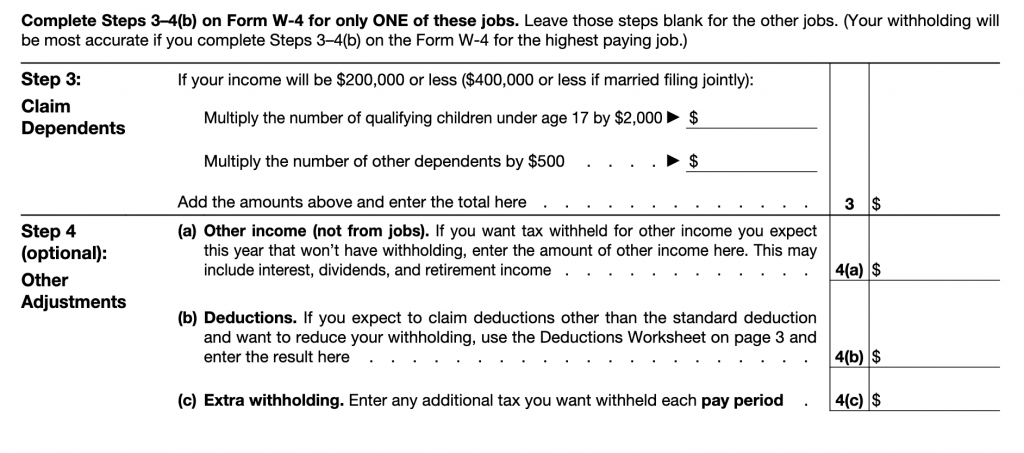

It also requires you to disclose some personal information to your employer such as if your spouse works, you claim your parent, you have investment income, or if you have another job.

The form encourages you to only include your deductions on the W-4 from your highest paying job. I’m assuming if you don’t fill out any deductions, it will be similar to claiming Single 0 or Married 0 on the prior form.

You also have the option to increase your withholding at work to cover any taxes on contract income you may have. Although, again, you will have to disclose this income to your employer.

The IRS has a calculator to try to help you navigate this form (www.irs.gov/W4App) but you’ll need a lot of info in order to use it:

It isn’t required for everyone to fill out a new W-4 just because of this change, but if you need to adjust your withholding, you will have to use the new form. Here’s a link to see the whole form and the instructions: https://www.irs.gov/pub/irs-pdf/fw4.pdf

When in doubt, ask your tax person! They can always help you navigate this form. It would also be a good idea to check in with them mid-year to make sure your withholding is on track. That will give you enough time to make any adjustments so there are no surprises when you file your taxes.